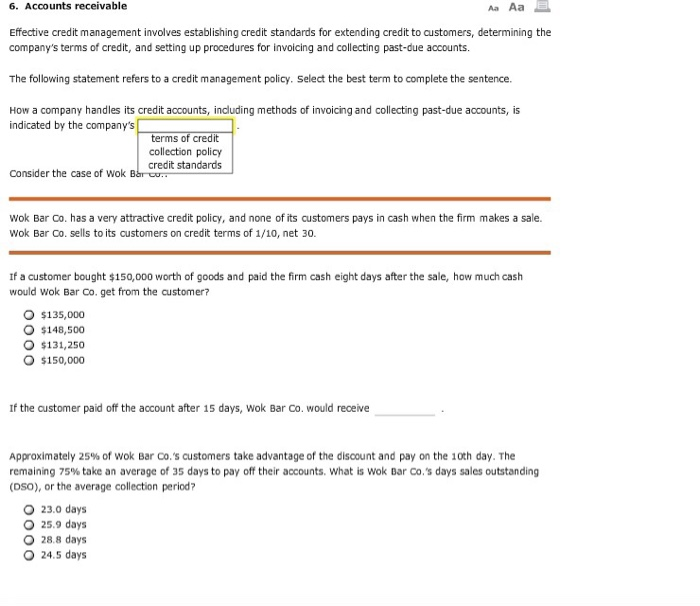

This helps to maintain accurate data on the number of transactions for which you have collected a balance.Ĭompany strength: accounts receivable can also give you an insight as to how well the company is operating financially. Receivables turnover ratio: accounts receivable allows financial professionals to determine the receivables turnover ratio for a company. Other reasons why accounts receivable is useful include: You can apply it to companies of all sizes as long as they engage in transactions with third parties. The process can also help you determine the liquidity of a company. Related: What does an accountant do (role and responsibilities)? Why is accounts receivable useful?Īccounts receivable is a useful process for companies and can help accountants or other financial professionals to maintain transactional history for a company. This can involve overseeing invoices and payments. You may work as a receivable accountant, monitoring the accounts receivable process and also recording and monitoring these transactions in real time as soon as they occur, instead of when you receive the payment. You can extend credit to this buyer, allowing them to pay what they owe you in instalments and set the time frame in which this customer makes repayments. This represents money still owed to the company.Ī business owner may offer accounts receivable services to returning customers or businesses with whom they interact frequently. If you work as an accountant, you may see accounts receivable within an asset account on a balance sheet. The purchase can be for a good or service, including the sale of products, taxes or donations. This can be a long- or short-term credit purchase. A buyer can make a purchase 'on credit', meaning they owe the business for the transaction at a future date. What is accounts receivable (AR)?Īccounts receivable, or AR, is a financial accounting term, that refers to a transaction that has taken place, but the customer or buyer has not yet paid.

In this article, we answer the question 'What is accounts receivable?', discuss the benefits of the process and explore examples of how it's used in business.

You can use the process to maintain a record of transactions, ensuring customers pay any outstanding balances and allowing you to establish an accurate financial history.

The function determines that there has been a transactional exchange between a business and its customers and there is a fixed balance due for payment. Accounts receivable is a financial process that you can use in the management of business transactions.

0 kommentar(er)

0 kommentar(er)